Talento Payroll

Discover seamless and flexible solutions tailored for your business

Say goodbye to payroll issues no more calculation errors, confusing deductions, or missed payments. With Talento, automate your entire payroll process, ensuring accurate results and saving valuable time for your HR team.

Discover Who Trusts Talento

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

69% of HR managers say they waste time on daily tasks that can be automatically done, Talento changes this

Allowances & Bonuses

Talento simplifies rewards management, empowering HR teams to effortlessly drive employee motivation and performance

Seamless Payroll Integration

Sync rewards with payroll reports for accurate and timely payouts, every time

Automated Performance-Based Rewards

Instantly calculate incentives based on employee achievements, performance goals, and promotions

Boost Engagement & Recognition

Streamline reward processes to celebrate top talent and inspire continued excellence

Payroll in a click

Policy-Based Calculations

Deductions and delays are automatically applied based on your company's policies

Accurate Reports

Generate clear, detailed reports that show the impact of deductions on overall payroll

Seamless Integration

Directly syncs with payroll to ensure each pay stub reflects the correct financial data

Empower HR Managers

Allow HR managers to approve deduction reports with a single click

.png?width=903&height=573&name=Frame%202147225847%20(1).png)

Easy Deduction Management

Talento automates monthly deduction calculations, eliminating the need for manual tracking. This not only reduces errors but also saves valuable time for your team.

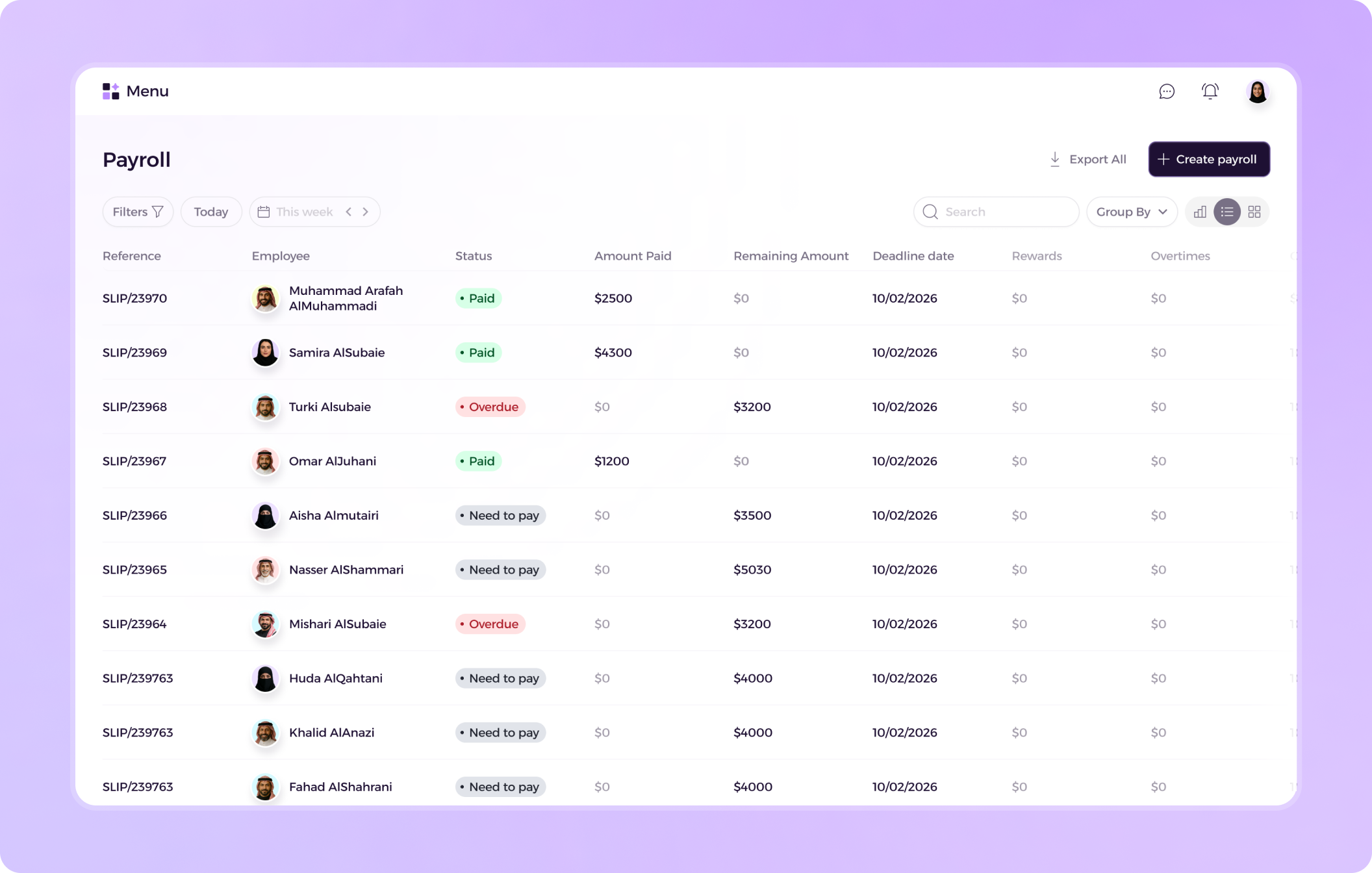

Simplified and Accurate Payroll Management

Talento Payroll enables HR teams to confidently manage employee payroll, ensuring all payments are accurate, timely, and error-free

Automated Deductions

Automatically apply deductions for lateness, absences, and unpaid leave no manual tracking required

Payroll Deductions

Easily manage payroll deductions for employees on extended unpaid leave, all with just a few clicks

Complete Payroll Accuracy

Eliminate errors and streamline the entire payroll process from calculations to final payment

With Talento Payroll, automate and simplify payroll management to ensure accurate calculations

That comply with local regulations saving time and reducing errors

Frequently Asked Questions

What is a payroll management system?

What is Talento?

Talento supports companies seeking to integrate and accelerate their human capital processes by providing a comprehensive business view through an integrated platform. It is built on a deep understanding of HR needs, offering an integrated platform that adapts to each organization's unique human capital needs.

Is the system customizable to comply with local labor laws?

Absolutely! Talento is fully customizable to ensure compliance with all local labor laws and regulations across Saudi Arabia and the Gulf Cooperation Council (GCC), helping your business stay legally aligned at all times.

Does the software integrate with the most important applications?

Yes, our software seamlessly integrates with leading payroll systems, ERP platforms, and other business tools through open APIs—ensuring a smooth, automated, and connected HR workflow.

Is the system secure? How does it keep employee data safe?

Yes, Talento is built with top-tier security measures, including end-to-end encryption, strict access controls, and regular backups. We also ensure full compliance with local data protection regulations.

Can Talento be tailored to align with our company policies?

Certainly! The system can be fully customized to match your internal HR policies, including approval workflows, leave management, and custom reporting—providing a tailored experience that fits your company’s unique operations.

Is Talento suitable for small businesses, or is it only for large companies?

Talento is designed to scale with your business. Whether you're a small startup, medium, or a large enterprise, our platform adapts to your company’s size and growth stage, delivering efficient HR solutions that evolve with your needs.

What is the difference between a payroll system and payroll management?

What is payroll processing and how does it work?

What is a payroll deposit and why is it important?

What is payroll tax?

What are payroll costs for businesses?

What is a payroll deduction?

What does payroll mean in HR?

What is payroll management and its main functions?

What is a payroll transaction?

Why is payroll important for businesses and employees?

How do you do payroll accounting step by step?

Payroll accounting includes:

- Collecting employee data (attendance, overtime, benefits).

- Calculating gross salary.

- Applying deductions (taxes, insurance, benefits).

- Recording payroll transactions.

- Issuing payroll deposits.

A payroll management system automates these steps, reducing time and human error.